Not known Facts About Life Insurance In Dallas Tx

Table of ContentsTruck Insurance In Dallas Tx Can Be Fun For EveryoneIndicators on Commercial Insurance In Dallas Tx You Need To KnowA Biased View of Truck Insurance In Dallas TxThe Only Guide for Insurance Agency In Dallas TxSome Known Questions About Insurance Agency In Dallas Tx.Home Insurance In Dallas Tx Things To Know Before You Buy

The premium is the quantity you pay (usually month-to-month) for medical insurance. Cost-sharing describes the section of qualified health care costs the insurance firm pays as well as the portion you pay out-of-pocket. Your out-of-pocket expenditures may include deductibles, coinsurance, copayments and also the full cost of healthcare services not covered by the strategy.This type of health insurance policy has a high insurance deductible that you have to fulfill prior to your health insurance coverage takes impact. These plans can be right for individuals that desire to save money with low monthly costs as well as do not prepare to use their medical coverage extensively.

The downside to this kind of insurance coverage is that it does not fulfill the minimal essential insurance coverage called for by the Affordable Treatment Act, so you might likewise undergo the tax obligation fine. Furthermore, temporary strategies can omit coverage for pre-existing conditions. Temporary insurance policy is non-renewable, and doesn't include protection for preventative care such as physicals, vaccines, dental, or vision.

Indicators on Life Insurance In Dallas Tx You Need To Know

Consult your own tax, accounting, or legal expert instead of counting on this write-up as tax obligation, bookkeeping, or lawful suggestions.

You can usually "omit" any kind of home member that does not drive your automobile, however in order to do so, you need to send an "exemption type" to your insurance provider. Motorists who only have a Student's Permit are not needed to be detailed on your policy till they are completely certified.

The smart Trick of Health Insurance In Dallas Tx That Nobody is Talking About

You require to purchase insurance to secure on your own, your household, and your wealth (Health insurance in Dallas TX). An insurance plan could save you countless dollars in case of a mishap, ailment, or disaster. As you hit specific life landmarks, some plans, consisting of wellness insurance as well as automobile insurance coverage, are basically needed, while others like life insurance policy and also disability insurance are strongly urged.

Crashes, illness and disasters happen constantly. At worst, events like these can plunge you right into deep economic wreck if you do not have insurance to fall back on. Some insurance coverage from this source are inevitable (think: car insurance coverage in a lot of US states), while others are he has a good point merely a clever economic choice (think: life insurance policy).

Plus, as your life changes (say, you obtain a new work or have a child) so should your coverage. Below, we've explained briefly which insurance protection you should highly think about purchasing every stage of life. Keep in mind that while the plans below are organized by age, certainly they aren't ready in stone.

Life Insurance In Dallas Tx Fundamentals Explained

Below's a quick overview of the plans you require and also when you require them: A lot of Americans need insurance policy to manage healthcare. Picking the strategy that's right for you might take some research study, however it functions as your first line of defense versus clinical financial debt, among largest resources of debt among customers in the US.

In 49 of the 50 US states, vehicle drivers are required to have auto insurance to cover any potential residential or commercial property damage and also physical damage that may result from a crash. Automobile insurance policy prices are greatly based upon age, credit score, automobile make and also design, driving document as well as area. Some states also think about gender.

9 Simple Techniques For Life Insurance In Dallas Tx

An insurance firm will consider your residence's location, along with the dimension, age and develop of the house to establish your insurance coverage costs. Homes in wildfire-, twister- or hurricane-prone areas will certainly generally regulate higher premiums. If you sell your home and go back to leasing, or make various other living setups (Commercial insurance in Dallas TX).

For people that are maturing or disabled and also need aid with day-to-day living, whether in an assisted living facility or with hospice, long-term treatment insurance can aid carry the outrageous prices. This is the type of point people do not think of up until they age and also recognize this may be a fact for them, however obviously, as you get older you obtain much more costly to insure.

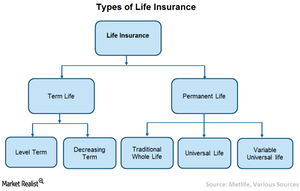

For the a lot of component, there are two kinds of life insurance policy plans - either term or irreversible plans or some mix of both. Life insurance firms use different forms of term plans and traditional life plans along with "rate of interest visit sensitive" products which have come to be a lot more widespread considering that the 1980's.

The Of Truck Insurance In Dallas Tx

Term insurance coverage offers defense for a given time period. This period can be as short as one year or provide coverage for a details variety of years such as 5, 10, twenty years or to a specified age such as 80 or in many cases approximately the oldest age in the life insurance coverage mortality tables.

The longer the guarantee, the greater the preliminary premium. If you pass away during the term duration, the company will certainly pay the face amount of the plan to your beneficiary. If you live past the term duration you had picked, no benefit is payable. Generally, term plans offer a fatality benefit without cost savings aspect or money worth.